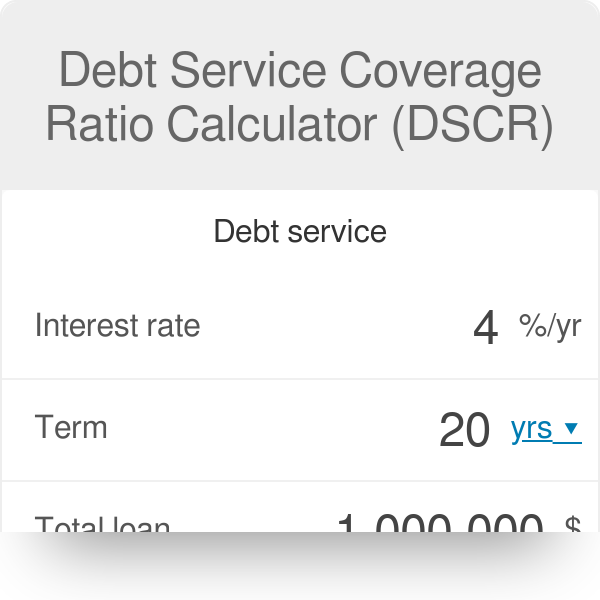

Commercial debt service ratio calculator

If your debt service coverage is greater than 125 including your new. Commercial Loan Calculator is intended for creating sample payment scenarios Debt Service Ratio Calculator One important benchmark used by lenders is the Debt Service Coverage Ratio.

How To Calculate Debt Service Coverage Ratio Dscr

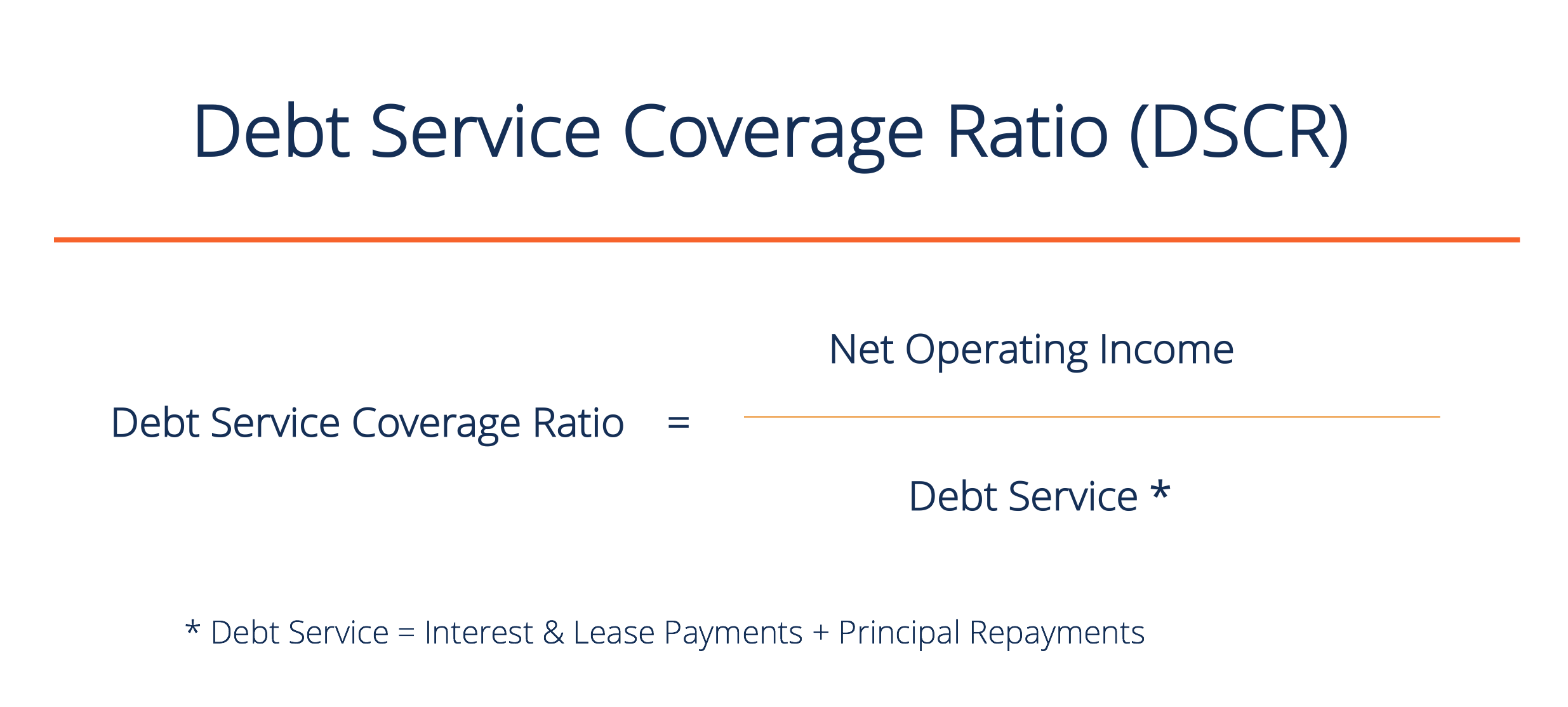

Briefly the debt service coverage ratio.

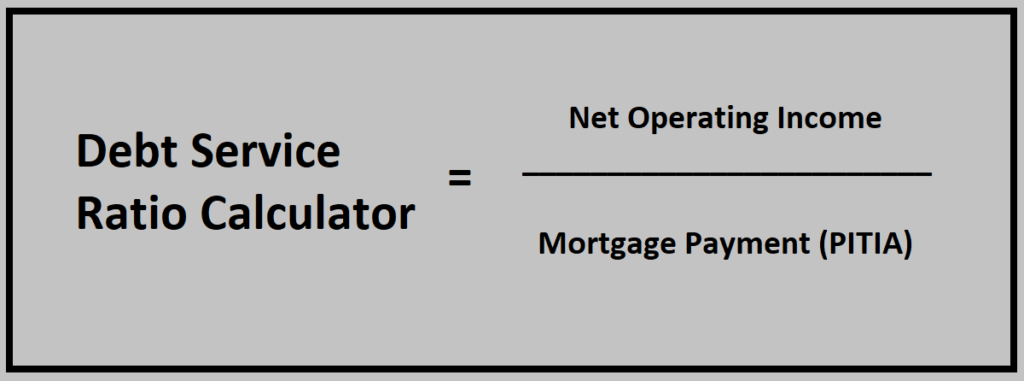

. The debt service coverage is determined by dividing the total annual income available to pay debt service by the annual debt service requirement. Our DSCR calculator enables you to calculate your companys debt service coverage ratio DSCR with ease. Debt Service Coverage DCR Calculator.

Debt Service Coverage Calculator. This is the ratio of debt payments to the household gross income. Debt-Service Coverage Ratio DSCR.

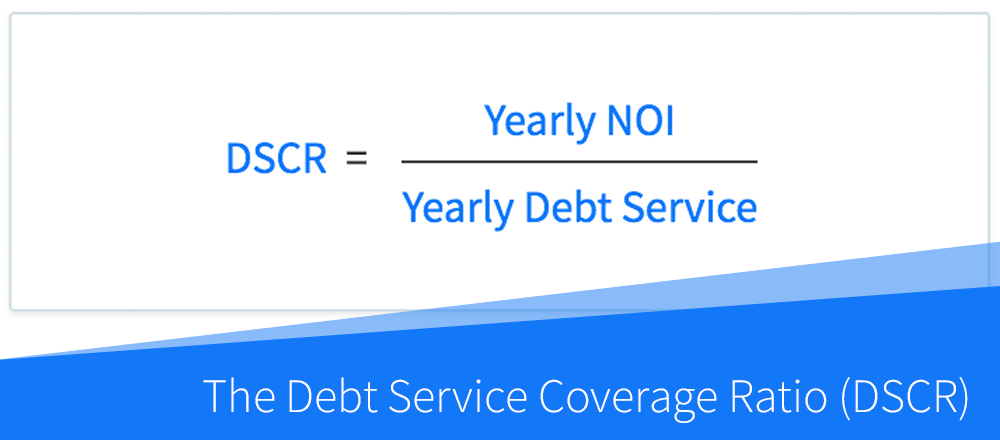

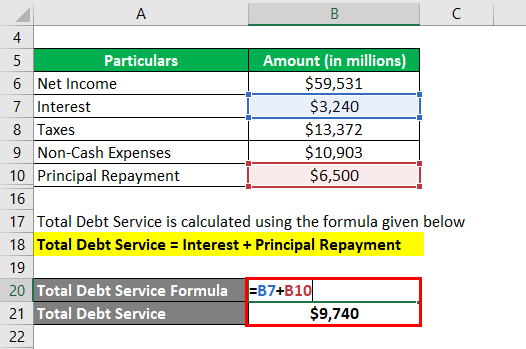

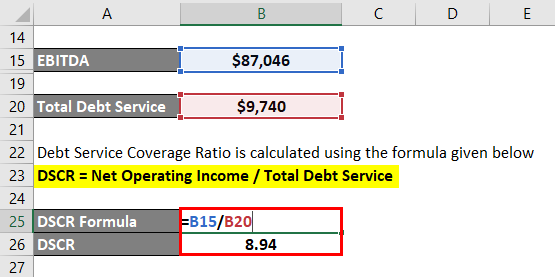

The DSCR or debt service coverage ratio is the relationship of a propertys annual net operating income NOI to its annual mortgage debt service principal and interest payments. This calculation should look at both the owner and the business to provide an. For example suppose Net Operating Income.

While several factors are considered in commercial loan underwriting debt service coverage is primary among them and indicates a borrowers. For commercial real estate the debt service coverage ratio DSCR definition is net operating income divided by total debt service. Commercial Loan Calculator Use this calculator to estimate your debt service coverage with a new commercial loan.

Assume the following loan terms. Our simple debt service coverage ratio calculator DSCR will help you understand your businesses ability to pay back its short-term debt obligations in cash. Lenders and investors typically seek DSC.

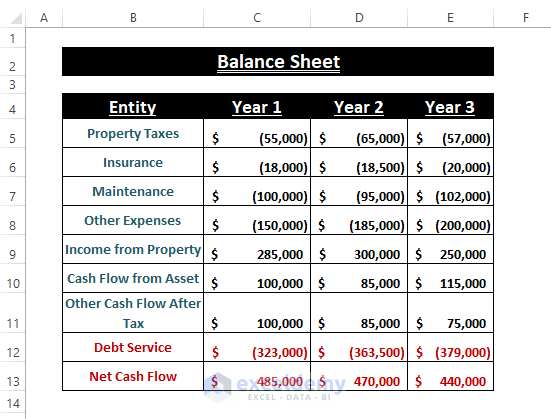

Simply complete the fields in the form below and click Calculate button. The debt service coverage ratio calculator has a different calculation when it comes to global calculations. With these numbers in mind we can now calculate the debt service coverage ratio of this apartment building.

In multifamily and commercial real estate debt service coverage ratio or DSCR is a measurement of a propertys cash flow in relation to its debt obligations. In corporate finance the Debt-Service Coverage Ratio DSCR is a measure of the cash flow available to pay current debt obligations. Today The typical minimum ratios for income property are 1101 to 1251.

The debt service coverage ratio is one of the least understood underwriting requirements for new and even seasoned commercial real estate investors. 1101 means that the borrower has 110 of net. On top of the main wage earners salary it includes the salaries of the households other wage earners bonuses.

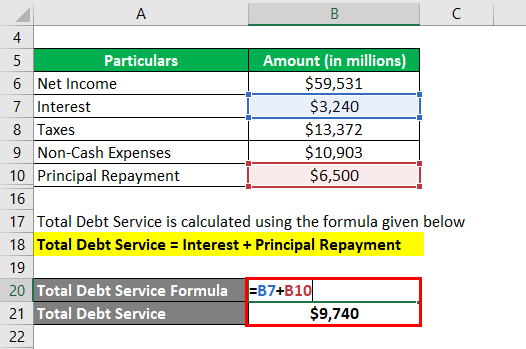

Debt Service Coverage Ratio Formula In Excel Exceldemy

:max_bytes(150000):strip_icc()/DSCR-b224f0db64184eae800e27598a8bc2d7.png)

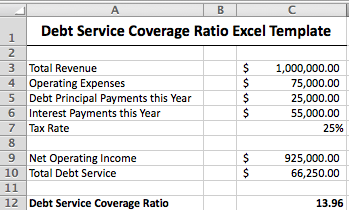

How To Calculate Debt Service Coverage Ratio Dscr In Excel

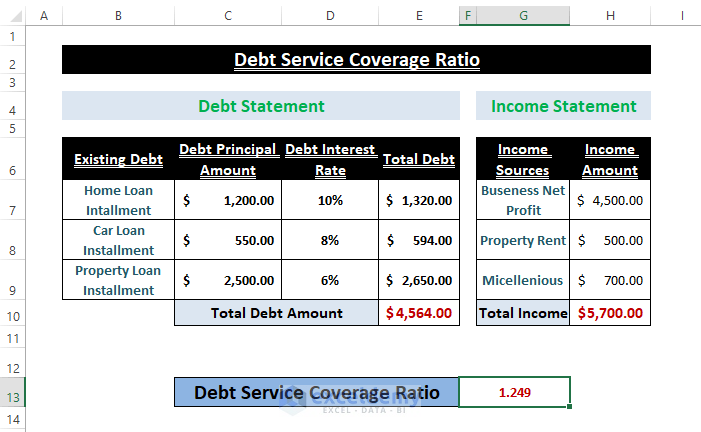

Debt Service Coverage Ratio Dscr Formula Example Excel Template

How To Calculate The Debt Service Coverage Ratio Dscr In Real Estate Dealcheck Blog

Debt Service Coverage Ratio Calculate Dscr With Practical Examples

What Is Debt Service Coverage Ratio Free Calculator Included

How To Calculate The Debt Service Coverage Ratio Dscr Propertymetrics

Debt Service Coverage Ratio Calculate Dscr With Practical Examples

/DSCR-b224f0db64184eae800e27598a8bc2d7.png)

How To Calculate Debt Service Coverage Ratio Dscr In Excel

Dsr Loan For Investment Properties Debt Service Ratio Calculator

How To Calculate The Debt Service Coverage Ratio Dscr Propertymetrics

How To Calculate The Debt Service Coverage Ratio Dscr Propertymetrics

Debt Service Coverage Ratio Formula In Excel Exceldemy

Debt Service Coverage Ratio Calculator Dscr

:max_bytes(150000):strip_icc()/DSCR5-d5bf42881e1348a48cc306f6fdc92d6f.jpg)

How To Calculate Debt Service Coverage Ratio Dscr In Excel

Calculate The Debt Service Coverage Ratio Examples With Solutions

Debt Service Coverage Ratio Calculate Dscr With Practical Examples